|

|

| Why Life Insurance |

| |

Why do we need Life Insurance

The formula for living is simple. You begin with waking up and end the day when you go back to bed. What you do in between, is what determines the course of life.

Let us see the situation on a man who was doing well in his career, was a caring husband and a doting father. Being the super achiever that he was, life was moving smoothly till he finally entered his forties and he decided to pay greater attention to his body, a move to preserve good health. One morning as he went out for a morning walk, little did he know that it was the last time his children would see him.

Tragically hit and run over by an errant truck meant that the sole bread winner of the family was no more. His wife, a home maker, shattered by the loss of her partner, was then left to struggle with a mortgaged home, a car loan EMI, the kids school fees and insufficient savings.

Like we said, small incidents during the day can completely change the way our lives move. From a comfortable sheltered life to the life of a struggling widow, the lady paid the price for her husband neglecting a very important need called life insurance.

Life Insurance can never fulfil the vacuum created by the loss of a dear one, but it certainly helps overcome the financial loss that we have to bear as a result of that loss. To appreciate the importance of insurance better, we must understand the concept of Human Life Value (HLV) first.

Human Life Value (HLV)

The most common definition of HLV is the expected life time earnings of an individual, i.e. what is the total income that the individual is expected to earn over the remainder of his working life, expressed in present Rupee terms.

To make the HLV more relevant, there are some critical points:

One, HLV is a moving target and to make it meaningful, you must review it once a year. Rather than chasing the revised HLV year after year, the aim should be to get the broad trend right.

Two, do not get overawed by the HLV numbers thrown up. The 'number' is just a starting point and must be put into the context of one’s present ability to set aside money.

Three, remain disciplined in the sense that at any point in time you should have planned in such a manner that in your absence, your family will not need to compromise on their yet-to-be fulfilled needs.

|

|

| |

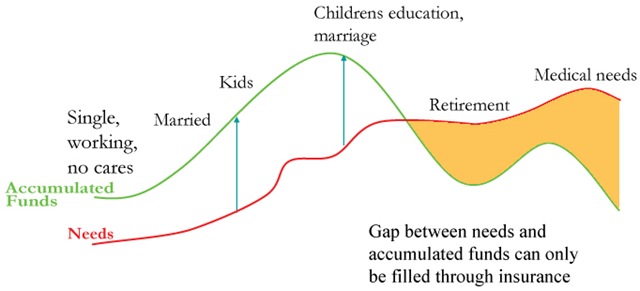

Insurance provides us with a means to provide our loved ones with a large amount in case of our sudden demise, one that can be equal to or more than our Human Life Value. That way we ensure that even when we are no more, our loved ones still maintain the standard of living that we would like to provide them in our presence.

If you haven’t yet thought of life insurance, its time you revisit that area. Speak to our experts, who will not only guide you to calculate your insurance requirement but will also work with you to find the best insurance policies that help you meet your insurance goals. |

| |

|

|

|