|

|

| Traditional Insurance |

| |

The oldest form of insurance policies are often described as traditional insurance policies. These policies are well suited for investors having a lower risk appetite.

Usually these policies declare a bonus called a reversionary bonus each year that accumulates until maturity. At the time of maturity there may be a terminal bonus that may be declared depending upon the

A new range of traditional policies also called non-participating products have also been launched by many companies. These products offer a slightly higher degree of transparency in returns although still much less than ULIPs.

Overall traditional policies whether participating or non-participating, can be divided into various broad categories:

Child Plans

Retirement Plans

Moneyback plans

Whole Life plans

Endowment Plans

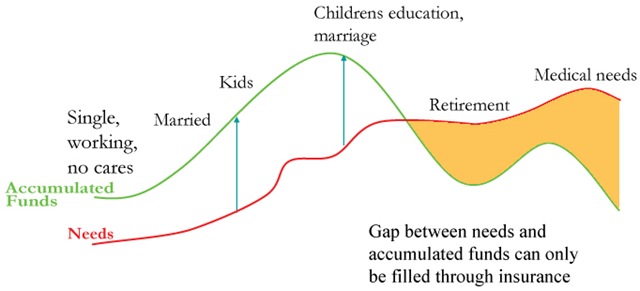

Insurance, if used well, can be an excellent instrument to complement other investments in our portfolio and one that may bridge the gap between our future needs and available funds.

|

|

| |

Traditional insurance policies are longer term instruments and at MoneyMinar we always believe that these policies tend to give us returns only when run till the full term. Unlike some other saving vehicles, these instruments attract a penalty if terminated prematurely and therefore early surrender must be avoided.

Before selecting a policy, it is advisable that we read the sales brochure and carefully understand the background of the person advising us the product. A well qualified person is more likely to understand the product well, and give us a suggestion best suited for us.

If you are looking at a traditional policy, it is best to consult our experienced team to understand the pros and cons of each instrument, so that yours is an educated and well researched decision. |

| |

|

|

|