|

|

| Residential Apartments |

| |

If you are looking to invest in property let our real estate experts at MoneyMinar guide you on taking the best decision. We carefully analyse different projects in and around Delhi – NCR and after taking into account your budget and requirements, shortlist the different options available.

Apartments as an investment

A residential property is a tangible investment, but before moving ahead, let us redefine an investment. An investment is money put into an instrument that may mature or may be liquidated prematurely to make gains. A residential house where we live cannot be treated at as a pure investment.

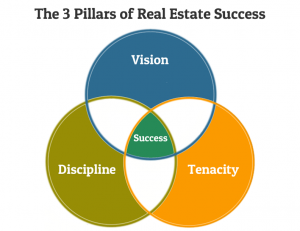

It is only an additional residential property apart from our house, or simply put a second residential property that we may call an investment. The 2nd property can then also act as a steady source of income by ways of rentals apart from the regular capital appreciation by way of price increase. Real Estate investments, especially incase of residential apartments, depend on three factors, vision, self discipline and tenacity

|

| |

|

| |

There are two kinds of residential property that are sought for:

1. Under-construction property

They are the new projects that are launched by builders, both renowned as well as the lesser known ones. These builders propose to construct residential units, and sell these proposed units under various payment plans

Construction Linked Plan – After paying the booking amount, the buyer continues to make the payment in various instalments called tranches as per the stage of construction. As the project keeps getting constructed, the builder calls for the next tranche.

Down Payment Plan: Even while the residential unit is not complete, the buyer makes full advance payment or about 95% in advance, while physical possession in some case maybe even 4 years away.

Flexi Payment Plan: Some where in between the construction linked and down payment plans, here the buyers pays about half in the beginning and the balance in tranches linked to construction.

Time linked plan: Few builders offer this where payment needs to be made in various tranches basis that are time linked. For eg : every 3 months

2. Ready to move in property

These are cases where an end user is looking to buy a fully constructed residential apartment, which has been or is about to be handed over by the builder. In this case, most transactions are of resale, where the original builder would have already sold off to an allotee and the unit is available on resale.

Such property means lesser risk as the chances of builder not completing construction are nil. While this is an excellent option for an end user, i.e. one who is looking to buy the house to live there, but for an investor it may pose some problems. Firstly, buying such a property may mean having to pay some cash component which banks do not fund under home loans. Second, maintaining or renting out the property is another hassle that one needs to face.

This brings us to the question that as a novice, which type of property should I buy?

Well to answer it in one line, your risk appetite is the deciding factor. Under construction property is a high risk – high return option, while a ready to move in option mean lower risk and lesser gains.

Simply fill in the query form above to consult our Real Estate Experts |

| |

|

| |

|

|

|